On 8 January 2021, the Civil Justice Council (CJC) Working Group on Guideline Hourly Rates published its report for consultation on guideline hourly rates (GHRs). The consultation ends on 31 March 2021.

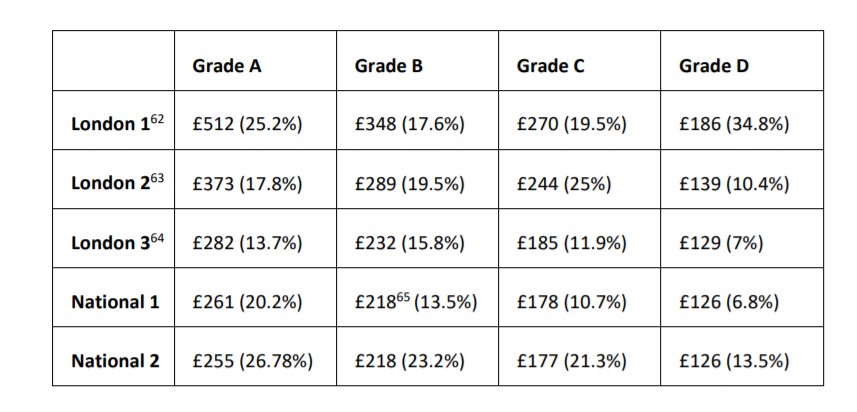

GHRs have not risen since 2010 and the report recommends increases ranging from 6.8% to 34.8% depending on grade and location.

The principles of hourly rates and summary assessment, as compared with the actual rates, were last published in 2005: the Guide to the summary assessment of costs. Appendix J to the current report is the draft new guidance.

In recent cases the courts have been applying their own upgrades to the 2010 rates.

The proposed new rates are:

The remit of the Working Group was very narrow (essentially a mathematical exercise), and so what follows is not a criticism of the CJC; rather, I am using the discussion to question the whole basis of GHRs in the modern world.

The CJC, at paragraphs 3.12 and 3.13 of their report, specifically rejected pausing the report to consider the effects of COVID-19 and also the extension of fixed recoverable costs:

“3.12. Another suggestion was that the report be paused because of the effect Covid-19 was having on the business models of solicitors’ firms. It was not within our remit to pause the review. Nor did we believe it to be necessary or appropriate. We have taken this factor into account in our recommendation for a further review within a relatively short period of time.

3.13. Fixed Recoverable Costs (“FRC”) are still under review and are said to be likely to extend to cases of up to £100,000 in value. A pause of our review was therefore suggested to await the outcome of new provisions on FRC. Again, this is not within our remit; nor is it necessary or appropriate. We were required to report by Trinity term 2021 by conducting an evidence-based review of the basis and amount of GHRs.”

The report itself (page 14, footnote 22) refers to a correspondent expressing concern that “…using a dataset of historic hourly rates will only serve to “bake” into any new GHR the overheads and inefficient business practices of pre-COVID business models that are changing as a result of digitalisation and remote working”.

Add offshoring to that, which is remote working carried further to the extent that it is not remote at all. I will return to that concept.

Essentially the GHRs are a combination of (i) the seniority of the lawyer and (ii) the location of the lawyer.

Seniority

Insofar as there are to be hourly rates, I would scrap them all and have fixed recoverable costs for everything, then there is logic in higher rates for more senior lawyers where the case warrants it.

Location

Why should location now be of any relevance whatsoever?

London offices have been shut for nearly a year; work has gone on from where the lawyers live, that is Hemel Hempstead or Reading or Kent or wherever.

Now lawyers and everyone else should be free to have offices wherever they want, but how can there be any justification now for a paying party to pay for very expensive London rents and salaries?

To put this in context, for a Grade A lawyer the Central London proposed recoverable rate is more than double that for National Band 2, which is where many of those lawyers live, and for the past year, where they have worked.

Do the paying clients care which location the lawyer is in? Of course not. Remote working has been brought into sharp focus by COVID-19, but it existed before then.

Suppose a Central London firm has, at any one time, half of its staff working from home, and so has half the rent, half the rates, half the fuel bills and so on, although of course not half the salary bill.

Should the hybrid situation not be reflected in a lower hourly rate? This is really only a refinement of the principle set out in Wraith v Sheffield Forgemasters Ltd, Truscott v Truscott.

Most of the staff of Underwoods Solicitors work in Wellington in the Western Cape of the Republic of South Africa. That is where our secretarial work is done, our phones answered, and much of our routine legal work is done. It is where I am now.

Our overheads are lower; our operation is more efficient as we have qualified typists doing the typing, rather than two-fingered lawyers claiming lawyers’ hourly rates for typing badly. We should get extra for our innovative approach, not less.

We have people studying in Wellington to qualify as Chartered Legal Executives, and no doubt, in due course, solicitors of England and Wales. What will the GHRs be for such people? Will an entirely unqualified person in England and Wales be able to recover more for their work than a fully qualified solicitor who happens to be based in South Africa?

What about me personally? Am I suddenly worth less because I am sitting in an office in Wellington in the Western Cape rather than in Hemel Hempstead? What hourly rates do I charge for my colleagues sitting with me here in the office in South Africa? If I am working on a file and I travel from Hemel Hempstead to the Western Cape via Qatar, as I have just done, do I charge different rates depending on where I happen to be?

Do I have a break when the plane is flying over Central Africa on the basis that I would get really low hourly rates there?

You have the regulators in their usual way saying that in matters such as conveyancing, clients should look to instruct solicitors hundreds of miles away if the clients live in the south of England, so as to save money because fees are lower elsewhere. The end game of that is to instruct English qualified lawyers in South Africa or India or wherever.

Of course, to my clients the value is exactly the same, and they are happy to pay the same fee wherever I am.

This blog post has been entirely researched, written, and typed in the Western Cape. Would it be more valuable if it had all been done in Hemel Hempstead?

Will we shortly see a Costs Master sharply cutting the hourly rate for 100 hours of document review in Central London, on the basis that it could have been done at a third of the price in South Africa by lawyers qualified in England and Wales? If not, why not?

Unsurprisingly, Underwoods Solicitors and the five firms we carry out work for in South Africa have the fixed costs work done here (no issue of GHRs), and keep the open costs work in England and Wales.

That is madness. GHRs by reference to location is the equivalent of taking into account the increased costs of quill pens and carrier pigeons.

I mentioned above remote working, but 19 people in an office here in Wellington does not feel like remote working; it is just economic common sense (saving on the cost of delivering the service), just as it makes economic sense to have clothes made in cheaper jurisdictions.

Why should the legal profession be any different?