Every growth industry has its critics, usually those with most to lose. Litigation funding is no different and they will be rubbing their hands with glee at the ongoing Australian review considering capping funders’ returns at 30% of the award. This would have far reaching consequences for the whole industry.

However, a closer look at this particular battle highlights one characterised by rhetoric, ego and self-interest, rather than the main issue at hand: the real value of litigation risks.

The industry is in part to blame. Through its rapid growth, it has neglected developing the understanding and articulation of the real value of litigation risks. A funder’s post on pricing often focuses on what pricing levels are, instead of why pricing levels are where they are. This is the industry’s Achilles Heel because it’s a fact: funders’ returns look expensive.

In this blog, I look at two pricing methodologies which reference established principles and real data to validate industry pricing levels.

Current pricing levels

The most common pricing structure is the greater of a share of the award (typically 30% to 40%), or a multiple of the capital (typically 3x). This seems expensive but there is nothing new about them. Plaintiff lawyers in the US have ran cases at these prices for years, for example Anderson v Pacific Gas and Electric Co in the 1990s, popularised by the Hollywood movie Erin Brockovich, where the Masry & Vititoe, acting for the plaintiffs, received 40% of the $333 million settlement.

This, however, was celebrated as a “David and Goliath” victory for justice, and those fees were seen as deserved, just and fair. Yet, despite pre-dating the funding industry, funders receive criticism for the same pricing levels because there is no validation of current pricing levels.

Approach 1: capital structure pricing

Capital structure pricing is simply an extension of accounting, looking at the assets on one side of the balance sheet matched by the liabilities on the other. In litigation funding, it is this matching that determines pricing.

In a corporate capital structure, the liability side is tiered. At the top, senior financing is the cheapest form of debt because it is first in line to receive the proceeds from the sale of the company’s assets in case of liquidation. Correspondingly, the more “junior” it is, the more expensive it becomes. Next comes “hybrid debt and equity” (think convertible bonds or preference shares) followed by equity, who receive the leftovers, both good (lots of money when successful) and bad (total loss when unsuccessful).

Therefore, corporates with established track records and proven business models can secure attractive senior debt, much like a house buyer with a strong credit score securing an attractive mortgage rate.

Conversely, a start-up business is risky and therefore cannot get cheap senior debt. When Facebook started in 2004, they would have borrowed senior debt at 1% per annum if they could. But they couldn’t, hence why they raised $0.5 million from Peter Thiel for a 10.2% stake (an implied valuation of $4.9 million, being $0.5 million divided by 10.2%). Hindsight shows what a fantastic investment that proved to be, but very few shared his optimism at the time when social media wasn’t even a “thing”. A year later, when Accel Partners invested $12.7 million on a $100 million valuation, not many thought it was a winner. In short, they took a huge risk and were rewarded for seeing and investing in something that others didn’t.

Litigation funding is no different. Erin Brokovich saw something in the PG&E case that others didn’t. Hindsight makes everything easy but when push comes to shove, very few have the risk appetite to invest in litigation.

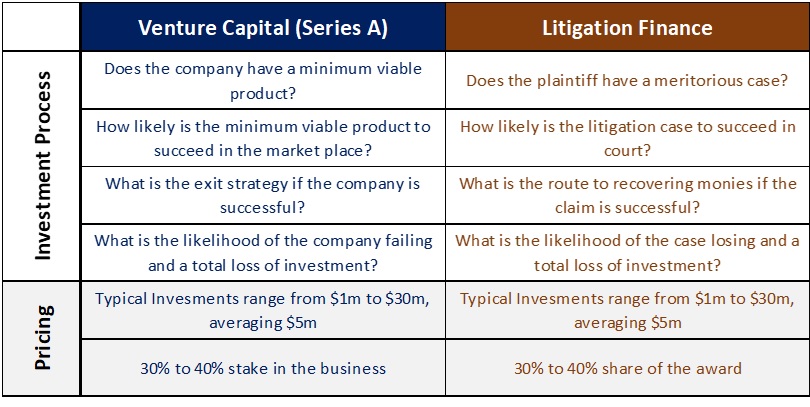

Litigation funding is in fact akin to Series A investing, the round of start-up investing following the initial seed. The parallels are clear:

30% to 40% of the business to get a 3x return may seem high but, in IRR terms, it is far more modest when one considers that:

- a 3x return over 10 years is a 14.9% IRR.

- a 3x return over five years is a 31.9% IRR.

Equally, a 0.25x return may seem cheap. However, a 0.25x return over six months is a 56.83% IRR.

In other words, multiples and shares of award in isolation is not a real gauge of actual pricing levels.

Validating with real data

In any investment portfolio, some will inevitably fail. 10% to 20% may be total write-offs and many will generate only modest returns. Outliers like Facebook are rare and real data reflects this. According to PitchBook’s Global Fund Performance Report (as of Q2 2020), venture capital’s ten-year horizon IRR was 13.2%, with private equity at 13.9% and real estate 12.3%. The IRR dispersion shows the top decile venture capital (VC) funds achieving 30%-type IRRs and the bottom decile in the minus 10% IRR range.

The same applies in litigation funding. While litigation funding data is generally limited, Burford Capital do make their investment data publicly available. Their direct investments data from 2009 through to December 2020 shows that out of 322 investments made, 148 have concluded, of which there were:

- 47 losses (31.8% by number but 17.7% when weighted by investment size).

- 6 flat returns.

- 95 wins (64.2% by number but 77.3% when weighted by investment size).

However, of these 95 wins …

- 7 returned greater than 3x invested capital.

- 17 returned greater than 2x invested capital.

- 39 returned greater than 1x invested capital.

… with the duration of investments varying from weeks to multiple years with an average duration on concluded investments of 2.3 years.

Not only is this realistic but, if read in isolation with no reference to litigation funding, this portfolio profile would be indistinguishable from a VC portfolio, reaffirming that litigation funding pricing is in line with other more established financial markets.

Approach 2: probabilities pricing

Probabilities lie at the heart of all financial pricing methodologies, so for those not swayed by capital structure pricing, this approach validates litigation pricing from a more academic angle.

Basic applications in theory and in practice

When a coin is tossed, there are only two outcomes.

Each has a 50% probability of occurring and if tossed enough times, each outcome should occur an equal number of times. If it costs $1 to toss a coin and ABC called “heads” each time, ABC must win $2 for every “head” to balance out the loss for every “tail”.

This 2x price ($2 on a $1 stake) is the pure price that leaves ABC with a flat return because ABC will lose $1 in 50% of the tosses and make $2 in the other 50%. In mathematical terms, the formula is:

[1÷50%] = 200% or 2x.

To expand, when a dice is tossed, there are six outcomes. Each has a 16.6% probability of occurring and, if tossed enough times, each outcome should occur an equal number of times. If it costs $1 to throw a dice and ABC called “two” each time, ABC must win $6 for every “two” to balance out the losses for every other outcome.

This 6x price ($6 on a $1 stake) is the pure price that leaves ABC with a flat return because ABC will lose $1 in 83.4% of the tosses and make $6 in the other 16.6% of tosses. In mathematical terms, the formula is:

[1÷16.6%] = 600% or 6x.

These basic principles apply to litigation. If a case has a 60% prospect of success, then the pure price should be:

[1÷60%] = 167% or 1.67x (including capital).

However, a funder may price 3x, which would equal [1÷33.3%], or an implied prospect of success of 33.3%. This difference is the gross margin. In the same way Apple could not exist if it sold iPhones at base cost of production, so litigation funding cannot be priced at the pure cost of the risk. This margin is necessary to pay for all the overheads of the business.

To illustrate this in a portfolio, let’s assume a funder made 10 investments each for $1 million priced at 3x. The performance is as follows:

- 4 losses for a total loss of $4 million.

- 6 wins, with each making $3 million, or $18 million in total.

$10 million invested and $18 million earned is a gross margin of $8 million. This $8 million must cover the overheads of the business. The balance is the net profit or EBIT.

Validating with real data

An $8 million margin may seem quite high, but gross margins must always be seen in the context of the business and when it is made. In litigation funding, that $8 million margin materialises only at the end which can often be years, during which time expensive in-house lawyers and other overheads (including marketing) and financing costs must be met. Only when these are all covered can the business report a net profit.

Each funder is unique and has its own metrics. However, Burford’s data again provides a useful reference point. The weighted success rate of 77.3% would imply a pure price of:

[1÷77.3%] = 129% or 1.29x.

On its concluded investments, the weighted average ROIC (return on invested capital) was 74.5%, which is 1.745x if one includes capital (as we have above for the purpose of illustration).

This implies Burford’s gross margin is 0.455x, being the difference of what they earned (1.745x) above the pure price (1.290x). As they deployed a total amount of circa $970 million over an 11-year period across those cases, Burford’s implied gross margin over those years was:

0.455 x $970m = $441.35 million.

This $441.35 million implied gross margin would have had to fund 11 years of significant overheads, with the balance of that being the net profit of the last 11 years. Assuming those overheads did not exceed $441.35 million, Burford would have made a profit on these investments. And of course, if those overheads exceeded $441.35 million, Burford would have made a loss.

Conclusion

The litigation funding industry has a tendency to avoid pricing conversations, primarily because many are run by litigators who do not understand pricing or do not want to share it. However, quantitative approaches, backed by reference to established financial markets and real data, add credibility and validation to litigation pricing.

Pricing is a complex subject matter to which a blog like this cannot do sufficient justice. But if the industry embraced and articulated approaches like those above instead of reverting back to the comfort zone of silence, the industry would be empowered to fight with real substance and neutralise those who attack the industry’s pricing levels on nothing more than whim, instinct and a healthy dose of self-interest.