In my prior blogs I examined “implied probability of loss” as a way of analysing the risk and price of transactions in the litigation funding market.

Let’s take for example (and with all the usual caveats about being reductive) a funder that determines that a case has, say, a 2/3 chance of winning and generating for both the claimant and the funder lots of money, and a 1/3 chance of losing with an attendant destruction of the funder’s entire investment. When pricing this case that funder must charge, on a win, $1.5 for every $1 invested just to break even. This is because the funder has a 1 in 3 chance of losing 100% and a 2/3 chance of winning 150%, which yields, on average, 100% (that is, a mere return of the funder’s investment).

This analysis requires a few assumptions, including that:

- The funder has a diversified book of investments of this sort and all of those are single-case investments (portfolios and other funkier deals complicate the picture).

- The funder’s operating costs are zero.

Now I want to quantify the impact of operating costs by looking at two hypothetical funders with different cost structures.

Example 1: high operating cost funder

Let’s look first at a hypothetical funder (Funder 1) that has high operating costs. I have loosely based these numbers on the 2020 accounts of a publicly-traded company in this sector so they have a semblance of realism but I have massively simplified the numbers and made numerous assumptions that are definitely false in order to make the maths easier (for example, I have assumed that this funder’s book is all single case risk, which definitely isn’t the case). Please don’t take this as any kind of meaningful analysis of that listed funder’s specific position!

Funder 1 deploys $250 million of capital into single case investments in one year, generates $150 million of net profits and its running costs for the year are $100 million. So Funder 1 makes an operating profit of $50 million. Let’s further assume that this funder wins two thirds of all cases and loses one third.

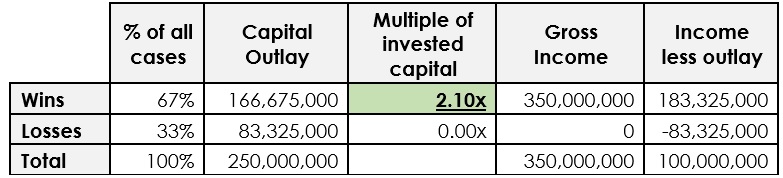

Using these assumptions, this funder needs to charge its claimants and plaintiffs a price of 2.1x invested capital on a win (that is, for each dollar the funder invests, it must earn a return of $2.10 if the case wins) in order to cover operating costs but not to turn any profit. The breakdown is as follows:

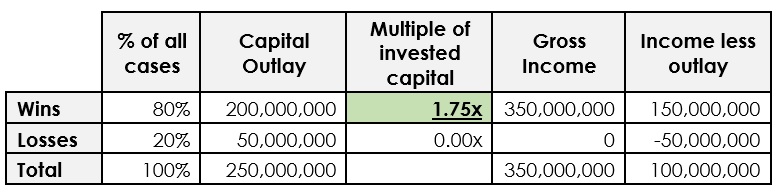

Now let’s see how the numbers respond if Funder 1’s general win rate is much higher. The below table runs the same calculation for a win rate of 80%. In that scenario, the funder needs to charge 1.75x capital to ensure the business washes its face.

Example 2: private funder charging 30% performance fees

Let’s compare this to a second hypothetical funder that runs at a lower cost (Funder 2).

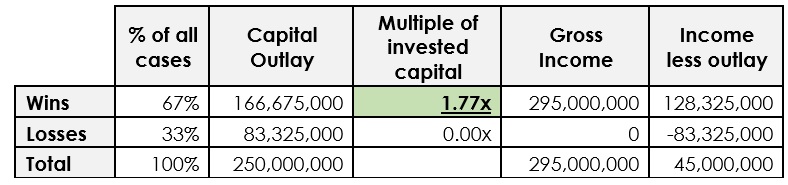

In my first example, Funder 1, is charging a fee equal to 66.67% of the profits from its investments ($100 million costs / $150 million gross profits). Most private equity and hedge fund structures are limited to a fee structure of something like 2% of committed capital plus 20% of profits. To make the comparison easier, let’s use a fee equal to 30% of profits with no fee charged on committed capital, which is an alternative fee structure sometimes offered. The operating costs for Funder 2, which operates with this 30% fee, are therefore scaled down from 66.67% to 30% as follows: $100 million * 66.67% x 30% = $45 million. Solving, as previously, Funder 2 needs to charge 1.77x to cover its operational costs.

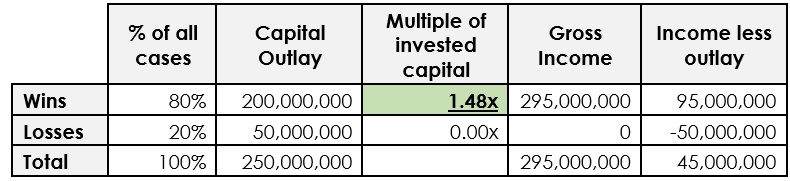

And with an 80% win rate, the numbers are as follows:

In practical terms, this means that, all else being equal, Funder 1 must charge significantly more than Funder 2, in order to defray its higher operating costs. The additional amount Funder 1 must charge on a $10 million investment is:

(a) $3.3 million, assuming both funders win 66.67% of their investments; and

(b) $2.8 million, assuming both funders win 80% of their investments.

So, contrary to the nice, clean world of my theoretical pricing model in earlier blogs, a funder’s running costs often consume a very large percentage of profits and that, in turn, results in higher pricing passed through to claimants and their lawyers.

Lost and fund

Of course, price is only a single factor. One reason that operating costs are very high for some funders is that they keep almost all of their due diligence in-house, which, in turn, involves a very large, highly-paid workforce and attendant increases in rent and other costs. A funder running that model will argue that all these megabrains ensure that Funder 1 achieves better outcomes than Funder 2. You can see from my tables that if Funder 2 achieves only a 66.67% win rate while Funder 1 achieves an 80% win rate, then the breakeven pricing for both funders is just about the same and that trend would continue if the win rate goes even higher so that, at some point, all the megabrains on the payroll start to make good economic sense.

Does hiring all those lawyers increase the win rate by enough to make Funder 1’s model always better? This is a pretty contentious subject and if a few more funders would share information about their performance we could measure the true impact from running larger versus smaller internal due diligence teams. Side note to other market participants: I’d be delighted if all funders were to get together and pool data anonymously to help the market analyse things like this!

But for argument’s sake let’s say that the “all in-house due diligence” model unambiguously yields a higher win rate. And let’s stick with my numbers above and say that Funder 1, with its higher costs, runs an 80% win rate while Funder 2, with its lower costs, runs a 66.67% win rate. What happens in the real world when these funders are bidding on a new case? Well, the win rate of different funders is a very important consideration for investors but as a user of funding you are looking only at your own case and the performance of that funder’s other investments is of no real relevance (see the excellent piece Doing Due Diligence on Litigation Funders by Dai Wai Chin Feman and Darnell Stanislaus, which could be improved only by including some bad wordplay in the title). Let’s ignore the improbable case of a funder that is so reckless that it funds anything to the point of risking its solvency and therefore your future funding; just as we’ll ignore the risk of a funder whose operating costs are so high that its business collapses under the weight of them which also jeopardises your future funding.

Now assume you are able to convince both funders that your case has a probability of success that is nearer to 80%. This case passes the underwriting criteria for both Funders. And, in fact, this is a significantly-better-than-average investment for Funder 2 when compared to its usual 66.67% win rate. Funder 2 ought to invest in your case and can do so at a price that Funder 1 cannot match. The key requirement to get Funder 2 to invest at the cheaper price is that the claimant or its lawyer must really be able to persuade Funder 2 that this case has that higher chance of winning. Funder 1 may argue that getting to this point would involve the lawyers spending more time holding Funder 2’s hand because Funder 2’s diligence is so unsophisticated that, without the handholding, it would have to factor in a greater number of “unknown unknowns” than Funder 1, which can be more confident that it has flushed out all the realistically knowable risks. And all that handholding comes at a cost to the lawyer running the claim, so perhaps there’s some cost-benefit analysis to be run by the lawyer running the case.

But the lesson for users of funding is that if you are dealing only with funders that have very large internal legal teams and high operating costs, as some funders do, try bringing in at least one funder with a lower operating cost. You should see your prices come down.