Litigation funding has typically focused on claimant side investment. Defence funding feels less valuable because it does not so obviously unlock an asset. In addition, the cash benefit of having a funder pay defence legal costs will often be dwarfed by the potential cash payout by the defendant on a loss. And finally, a defendant worth suing is usually not cash constrained in the same way as many claimants who seek funding. But as the funding market has matured, some funders, defence lawyers and their clients have begun to express interest in defence funding.

What is currently available in the market?

I recently attended a lecture given by a litigation funder, where the speaker was asked, “If defence funding emerges, how will it look?” The speaker answered that defence funding will likely work only as part of a portfolio, comprising mainly of claims or where there is a sufficiently meaty counterclaim to support the funder’s risk. In other words, defence funding will work only if subsidised by claimant-side funding and not on a standalone basis. In this blog, I explain why I think that that litigation funder was wrong, and how “true” single case defence funding might look without the need for support from claim portfolios or counterclaims.

Why would defence funding be attractive?

Even the most flush defendant will naturally seek to minimise its legal costs. And as with most recurring costs, legal budgets often (though not always) operate to reduce earnings before interest, tax, depreciation and amortisation (EBITDA). For any corporation being valued on the basis of a multiple of EBITDA, the negative impact of the legal spend will be multiplied into the valuation. This can be avoided by passing the obligation to fund legal budgets to a funder.

What are the difficulties with defence funding?

In any single-case litigation funding investment, the core risks that a funder will seek to assess during due diligence are legal merits (is the case likely to win or achieve settlement?), financial merits (are the numbers viable if the case is won or settled?), and collectability (is the claimant going to be able to convert any judgment, award or settlement into cash or other value?). These are relevant for defendant funding as well, but at least two additional issues arise:

- Who pays the funder on a “win”?

- How do we define the “win” payoff (that is, how much and in what circumstances does the funder get paid)?

Question 1: Who pays the funder on a “win”?

The defendant to litigation is seeking to minimise its losses; it is not normally pursuing a gain. Defence funding therefore typically lacks any obvious asset or pool of damages that the defendant will gain and that can be divvied up with a funder at the end of the litigation. It will therefore be the defendant who must pay the funder’s profit share out of its existing resources on a “win”, which is likely to be viewed by the defendant more as an “avoidance of loss”. However, this does not mean that defence funding cannot make good economic sense for the defendant, provided that the funder is paid only on the basis of a sensible definition of a win and the pricing is appropriate. For the funder, a defendant often represents a lower collection risk than a claimant; if a defendant is being sued for a substantial sum by a rational claimant, that is usually a good indicator that the credit risk of the defendant is low and it will likely be able to pay the funder any success fee.

Question 2: How do we define the win payoff?

In most litigation the range of outcomes is bounded by two extremes:

- A drop hands settlement or a judgment that awards zero to the claimant, perhaps with recovery of some costs by the defendant where applicable.

- A judgment that awards the entire claimed value to the claimant, with recovery of

some costs by the claimant where applicable.

In claimant-side funding, few funders would advance money if a “win” and hence a payout

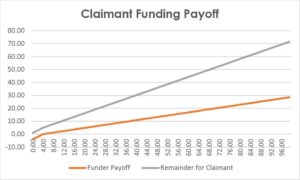

consisted only in achieving the second extreme, and similarly the definition of success for any funded defendant will lie somewhere between the two extremes. To achieve a good alignment with the funded party, a funder’s payoff ought to move in line with the funded party’s outcome. A simple pricing model for claim funding is for the funder to receive all of the winnings until it has recovered its investment, and thereafter to receive a fixed percentage of damages. The payoff graph for this pricing would look as follows (I’ve assumed the funder invests £ 5 million, which comes off the top, and then takes 30% of damages). The horizontal axis shows the settlement/judgment amount from 0 on the left to 100 on the far right.

There is a good alignment of incentives here: as the claimant gets a better and better result

(that is, we move from left to right on the graph), the funder gets paid more.

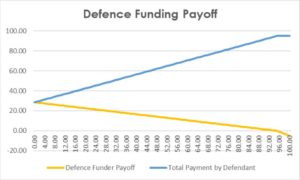

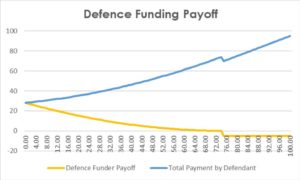

If we flip this structure so that it applies to defence funding (that is, the funder gets back 100% of the first £5 million below the maximum claimed amount plus 30% of everything below that number) the graph looks like this:

Again, there appears to be a reasonable alignment of incentives here: as the defendant gets a better result (that is, we move from right to left on the graph), the funder gets paid more.

But this model ignores the probability-weighting of each pound paid in settlement or judgment. Assume a claim has two types of loss: hard losses (say direct replacement costs) and soft losses (say consequential losses). If the funder prices on the same basis for both hard and soft losses, it is failing to account for the fact that some of those dollars may be much less likely ever to be paid than others. In the case of claim funding, this suggests that funders should take a larger percentage of damages as an award increases (which, incidentally, is the opposite of the way most funders currently price deals). In the case of defence funding, funders should take a lower percentage of the “avoided loss” initially but the percentage should rise as the avoided loss increases (of course, this is hugely simplified and all sorts of other factors go into settlement probabilities and values). The key difference is that a claimant gets its most credible damages first, whereas a defendant first avoids paying the least credible. Since a claimant funder is paid first from the highest probability-weighted pounds, the funder has less risk from getting the assessment wrong. However, in defence funding, the opposite is true and the funder has an incentive to exaggerate the probability-weighted value of the soft losses, since an exaggeration reduces the funder’s risk.

Many different pricing models will work, but below I show a simple idea where a funder receives return of principal when damages are below some base level (for example, where the defendant has avoided the very frothiest bit of the claim) and thereafter receives an increasing percentage of every marginal pound below that level. But, just as with claim funding, funders may instead price based on a scaling multiple of money invested on in any one of several different ways (as with claim funding, any pricing structure for defence funding should minimise the possibility of skewing the defendant’s behaviour in settlement discussions). For example, the graph shows that, somewhere around a settlement value of 75, the defendant repays the entire principal of the funder. On that pricing model, if settlement discussions coalesced around 75, the defendant would be indifferent to any settlement between 70 and 75, since the funder takes everything at those levels. There are various ways to address this problem but we don’t have space to cover them here).

Where’s the catch?

The above are the key structural features of a defence funding product. But there are a number of other issues to address. For example, a funder’s assessment of the risk of the claim may be significantly harder at the earlier stages of litigation than for most claimant funding, as defendant borrowers will typically be very large corporates with more limited “corporate memory”; no one individual may have sufficient information or key individuals may have left the institution. And perhaps most importantly, since this model of defence funding effectively guarantees that in all circumstances the defendant now becomes liable to pay some amount (either to the funder by way of success fee or to the claimant by way of settlement or award), the product may have an impact on the defendant borrower’s required litigation reserves. This may, in turn, reduce the accounting benefits that otherwise accrue to a large corporate from offsetting legal budgets. One simple way to address this problem is to provide defence funding as a facility across multiple claims. But, unlike the traditional funder approach outlined above, this facility needn’t cover primarily claimant-side litigation. Not only can such a structure avoid increasing litigation reserves but, if coupled with various insurance solutions, it can also permit a release of litigation reserves.

Defence funding is a harder and less obvious sell than claim funding and to date the only announced deals in this area are really counterclaim funding, which is not defence funding in any meaningful sense. But the scale of the opportunity is enormous and far too tempting for funders to ignore. Now that we have reached a point where defendants and their lawyers are expressing interest in funding, where a well-structured product can achieve real benefits for the borrower and where pricing and incentives can be properly aligned, I predict that the market will see at least one or two advertised transactions in the next couple of years.