In an earlier piece I proposed implied probability of loss as a means of analysing the risk of a single case investment. In this piece I will use the implied probability of loss to look at cases with different risks at different stages, and then to look at some different models for co-funding transactions with other funders, including a concept of dollar-weighted risk. Finally, I’ll propose a structure to allow two funders to fund a case that might otherwise be outside the risk parameters of either of them individually.

My analysis in this piece takes as its premise that information about different risks at different phases of a claim is known at the outset of the investment but the logic applies to other circumstances including, for example, where a funder seeks to sell a portion of its investment after some good or bad event has occurred and the buyer and seller must calculate how to apportion profits between themselves.

A (slightly) more sophisticated model

Some cases have starkly different risk profiles at different stages. Imagine you are considering funding a claim that requires US $5 million of funding. With all the caveats of my previous blogs about being reductive, assume that your due diligence has revealed that the prospects of winning on the substantive merits of the action and recovering in full are 70%.

However, there is a threshold issue about whether the relevant court has jurisdiction on the claim. That threshold issue is highly likely to be the subject of a preliminary hearing shortly after issuing the claim and if you lose on that point, the whole case is irretrievably lost. That threshold issue is much dicier than the substantive merits and you conclude you have only a 50% chance of winning on it. How should this be priced?

If your due diligence is correct then, at the outset of the investment, the probability of winning the case is 35% because you must win on both the preliminary issue and then also on the substantive merits. The probability of winning both events is 50% x 70% = 35%. Following the logic of my earlier article, using the probability of loss model the break-even pricing at 35% is:

1 / 35% = 2.86x capital.

That is, a funder with no running costs would need to charge a success fee to the borrower on this case of 2.86 dollars for every dollar invested at the outset of the case in order just to break even across a diversified book of cases of this sort. But this is correct only if the case has an all-in probability of success of 35% for every dollar invested. In fact, in our case, the risk transforms from 35% to 70% after success on the preliminary issue. So the true break–even price for investing throughout the life of the case, including both the preliminary issue and the substantive merits, depends on what proportion of the US $5 million budget is actually exposed at each phase. Let’s assume that only US $2 million of the total budget is required to be deployed in the first 12 months to resolution of the preliminary issue and the remaining US $3 million will be invested only if that preliminary issue is resolved successfully and the case therefore enters the substantive merits phase. We can calculate a different break-even price for each phase:

- Break-even pricing for dollars invested prior to resolution of preliminary issue equals 1 / 35% = 2.86x.

- Break-even pricing for dollars invested only once preliminary issue is successfully resolved equals 1 / 70% = 1.43x.

The average break-even pricing (weighted based on the proportion of the budget spent at each phase) comes to 2x, but note that a funder basing its pricing on a blended break-even rate would be under-calculating the break-even during the jurisdiction phase and over-calculating during the merits phase.

Rolling funder: different funders, different stages

Imagine two different funders agree, at the outset, to club together to fund the claim described above but each of them wishes to invest at a different stage of the case. One funder (low risk funder) wants to make a larger investment at the relatively low risk merits phase and only if the preliminary issue has been successfully resolved; and the other funder (high risk funder) is prepared to make a smaller investment from the outset and therefore will run the risk of both the relatively high risk jurisdiction phase and the low risk merits phase. The borrower has agreed to pay, on a win, invested capital plus some profit element and the funders must determine how to allocate that profit element between themselves on a win. I’ve set out three ideas below for how that allocation may be made but any number of others is also possible.

Model one: actual probability of loss

High risk funder takes a probability of loss of 65%, whereas low risk funder takes a probability of loss of 30%. On one crude measure, therefore, the ratio of the two funders’ relative risks is 68.42% for high risk funder versus 31.58% to low risk funder:

65% / (65% + 30%) = 68.42%.

On this basis, the funders allocate profits 68.42% to high risk funder and the balance to low risk funder. But this takes no account of the relative amounts at risk in each phase. Imagine if the amounts required to conclude the jurisdiction phase were only US $100,000 and the balance of US $4.9 million were allocated to the merits phase and funded by low risk funder. Unless the relative merits are skewed horribly against high risk funder it will almost always be a very raw deal for low risk funder to pay away 68.42% of the total profits when providing 98% of the total commitment. And the same problem would arise from the other side if the budget were flipped and, say, US $4 million were required for the jurisdiction phase and only US $1 million for the low risk phase.

Model two: risk-weighted commitments

To resolve this problem with model one, let us introduce the concept of risk-weighting. Since the budget in our example case is allocated two thirds to low risk funder and one third to high risk funder, we might add in a weighting for the funders’ respective commitments. The allocation to high risk funder in that case would therefore be calculated by dividing high risk funder’s risk-weighted commitment by the sum of both funders’ risk-weighted commitments as follows:

65% x 2 million / (65% x 2 million + 30% x 3 million) = 59.09%.

This isn’t miles away from the model one outcome, which I said was flawed, but that is just because funder one’s share of the total commitment is a fairly substantial proportion of the total. If we used the alternative commitment split that I gave above of US $100,000 versus US $4.9 million, the allocation would be:

65% x 100,000 / (65% x 100,000 + 30% x 4.9 million) = 4.23% to high risk funder,

which feels much more satisfactory in return for 2% of the total commitment than a 68.42% allocation.

Model three: risk-weighted dollars

High risk funder may object that, if the case settles very shortly after a successful jurisdiction hearing, model two will mean that the low risk funder will be paid a substantial portion of the profits, even though it has invested not a dollar. A variation on the risk-weighted commitments model, therefore, is to price based on the actual amounts drawn from each funder and then apply the risk-weighting to each dollar drawn. On this model, each dollar funded by high risk funder would be multiplied by 65%, whereas each dollar drawn from low risk funder would be multiplied by 30%. During the jurisdiction phase, therefore, when low risk funder has no money invested, 100% of any profit received will be allocated to high risk funder.

Both the drawing-weighted model and the commitment-weighted model suffer from the same problem, which is that they take no account of the probability of each funder’s money being drawn: the drawing-weighted model gives zero value to the probability of drawing any future money, and the commitment-weighted model assumes a 100% probability of drawing any future money. In practice, almost any claim will have some probability that it is either abandoned or settled prior to drawing the entire budget. A more sophisticated model, therefore, would be one that applied an additional weighting factor to the different funders’ committed dollars based on the realistic probability of drawing.

Funderstruck: how to get funders to fund more cases

One of the criticisms of some traditional funders is that it can be excruciating to get them to approve a case. This can be for entirely legitimate reasons; on the face of it a 35% probability of winning, as in my example case, is sufficiently small that few traditional funders would have the appetite to invest a meaningful amount into that claim. So it may prove difficult or impossible to find anybody to take the role of high risk funder in my examples above and the case might therefore remain unfunded.

But with a more creative funding structure, the risk and the profit allocation between the two funders can be modified in a way that makes the investment much easier to fund. Specifically, the low risk funder may be happy, on a successful outcome at the jurisdiction phase and therefore before the case has actually been successful and generated any income for the funders, to buy out some or all of the high risk funder’s investment.

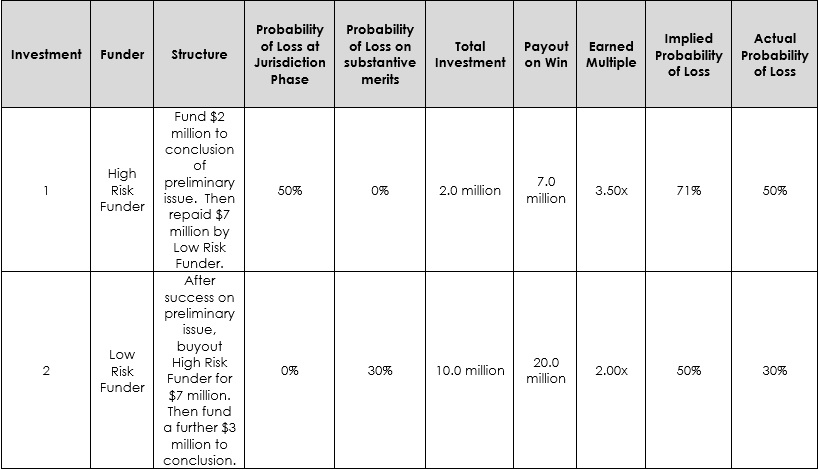

The effect of that structure can be to transform the risk of the investment from one that fails to meet either funder’s underwriting standards into two different investments, each of which individually has an acceptable probability of success and payoff. The probabilities and payoffs for one such structure are set out in the table below assuming:

- The case runs to a full conclusion on the merits.

- The full budget of $5 million is deployed.

- The borrower has agreed to pay to the funders, on success in the substantive action, a return of 4x capital.

- The low risk funder agrees to buy out the high risk funder at 3.5x capital upon success at the jurisdiction phase and then to fund the remainder of the action (the actual split will depend on all sorts of things and I trust none of my competitors will insist that I offer or take this particular pricing with them when we buddy up on the next deal…).

Some funders complain that they have to reject over 90% of the cases that they see and wish the market would show them more cases that fit their underwriting guidelines. Many borrowers and their lawyers complain about the same ratio and wish that funders would develop greater risk appetite. In most sophisticated financial markets the split of individual investments between high and low risk tolerance investors has been used for years. In the structure above, I hope I have given an example that the market for litigation funding can also find more creative structures to allocate and price for different elements of risk, permitting funding of more cases without the need for funders substantially to alter their underwriting policies.