There are many ways to price litigation funding transactions, and different funders and their investors may employ different methods even for the same investment. In this piece and a following part 2, I explain one method of pricing single case investments using a simplified fundamental analysis where “risk” is reduced to a straight percentage chance of winning or losing (which is obviously a simplified view of the world of litigation funding). I then look at pricing from the other end of the equation to determine what a funder’s pricing may imply about the risk of a case. Finally. I turn to some real-world applications of implied risk to explain why it is often irrational for funders to abandon cases, and whether funders are too expensive.

Breakeven pricing

Imagine you place a single chip on red at a roulette table. Assume, for these purposes, that there is no green 0 and so there are only two possible outcomes: red or black, each of which has a 50% probability of occurring. The house will double your money on a win and you’ll forfeit your stake if you lose. If you play this roulette wheel a statistically significant number of times, you’ll end up breaking even. In other words, the “breakeven payoff” for a gambler with a 50% chance of winning versus losing his or her entire stake is double the initial stake. Similarly, if your bet had a 25% chance of winning, the breakeven pricing would be 4x the stake. The calculation of breakeven pricing is 1 divided by the percentage probability of winning (1/50% = 2; 1/25% = 4).

Let’s assume that an investment by a funder in a piece of litigation or arbitration also has a binary outcome: either the case wins and the funder is paid its return, or the case is lost or abandoned and the funder loses its entire investment to that point. If a funder has determined that the prospects of winning or settling the case and recovering enough cash to pay the funder in full are 50% then, following the logic above, the breakeven price is 2x invested capital. If the funder invests in enough cases of this sort, it will break even across its book of business. For simplicity, I’ll assume throughout this blog that a funder’s operating and opportunity costs are nil. But, in practice, any funder who charged only what I have called the breakeven price (even if that funder’s investors didn’t expect to earn any profit) would be out of business. I’ve also assumed away adverse costs, since these will apply only in certain jurisdictions and will vary from case to case. However, in practice the calculation of breakeven pricing would also need to factor in the risk of a funder’s contingent adverse costs liability, if any.

Implied probability of loss

Now let’s look at the calculation from the other side: what does a funder’s pricing imply about the probability of losing a case? Since 1 divided by the percentage probability of winning gives you the breakeven price, 1 divided by the breakeven price will give you the implied probability of winning. And 100% minus that number will give you the implied probability of loss. In the simple example above, where a funder is pricing a deal such that it will earn 2x invested capital, the implied probability of winning is 1 divided by the breakeven price expressed as a multiple of capital. In this case 1 / 2 = 50%. Therefore, the probability of loss is 100% – 50% = 50%.

If a funder is able to earn a return that implies a probability of loss that is significantly higher than the actual probability of loss on a case then the funder will, on average, make a profit and it would be rational for the funder to invest in that case. The implied probability of loss has application in several circumstances. In these blogs, I will deal with two of them: first, whether a funder ought to continue with an investment once the merits of a case decline; second, to assess whether funders are charging too much versus the risk they are running. (Eventually, I’ll write another piece on some others, including how to allocate profits between a co-funder who joins a case at a different stage from the original funder.)

Of money, good and bad

Most cases hit a bump in the road at some point. When should a funder “double down” on a case that has had some unfavourable but not disastrous news and when should the funder cut its losses? Broadly, a funder should continue to invest provided that, following the bad news, the prospects of winning remain higher than the implied probability of loss to conclusion of the investment. To illustrate this, we must make two further assumptions:

- First, that if the funder abandons the case, the funder will suffer a loss of its investment up to that point (this is the “bad money”).

- Second, that if the funder decides to continue funding the case, then it expects that the full remaining budget will be drawn as the case will run to judgment (this is the “good money”).

The first assumption is true in most cases. The second assumption may or may not be true, but as you’ll see from the following calculation, if the funder assigns any probability greater than zero to a settlement before the full budget is drawn then generally the case for continuing to invest will be even more compelling.

The bad money is a sunk cost, meaning that its value is nil since it is irretrievably lost without injection of the good money. The idea of sunk costs is often used to restrain people from continuing with an investment that has worsened, that is, “throwing good money after bad”. But the corollary is that one should also ignore those sunk costs when calculating returns at the decision-making point. Thus, one should approach the new investment as an opportunity to invest only the remaining capital commitment and disregard the fact that the opportunity only arises because the funder has bought that possibility by paying the sunk costs. The funder is therefore assessing the implied probability of loss on an investment equal to the good money, but the potential returns on offer from that investment are equal to the full profit share on the entire investment, including the returns that are attributable to the historical investment of bad money.

For example, assume a funder originally assessed the prospects of success in a case at 60% (that is, a 40% probably of total loss). The funder committed USD $1 million to that case and priced the investment at 1.67x expended capital on a win. At this pricing, the implied probability of loss at signing was equal to the actual probability of loss (this funder will not be in business very long). Now assume that, after the funder has invested USD $250,000, a bad event happens in the litigation but the claimant and its lawyers still believe the case is fundamentally winnable. The funder must here assess whether to invest a further USD $750,000 of good money to have a chance of earning a return of USD $1.67 million upon success. For this fresh investment, the implied breakeven probability of loss is now 55%. (Profit share on a win at conclusion of the case = 1.67 million. Divide that profit by the remaining required investment to conclusion of 750,000 = 2.23x return on invested capital. Implied probability of win = 1/2.23 = 45%. Therefore, implied probability of loss = 1-45% = 55%.) Therefore, provided the case has greater than a 45% chance of winning, it would be rational for the funder to follow on with the additional USD $750,000.

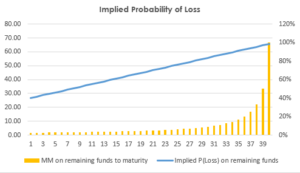

Consider a case where the funder invests an equal amount per month for 40 months and, on a win, will earn 1.67x invested capital. The graph shows, for each month, the multiple of invested capital (left hand scale) and the implied probability of loss (right hand scale) if that case were funded to maturity to the extent of the remaining “good money” at that point. In other words, if a bad event happened in any month, what would have to be the funder’s assessment of the probability of loss at that point for it to be irrational for the funder to invest its remaining commitment amount.

As the graph demonstrates, the greater the proportion of invested capital at the time of the bad event, the higher must be the probability of loss before a funder should abandon the case. This is intuitive at the margins, such as a situation where, from a budget of USD $1 million, the entire amount has been invested other than the final USD $1. In those circumstances, the marginal cost of USD $1 is almost always worth risking to have a chance of “saving” the entire USD $1 million investment plus profit share unless the case has become hopeless.

To be continued…